Alvarez and Marsal’s Corporate Transactions Group (CTG) is poised to disrupt the Mergers and Acquisitions (M&A) professional services landscape. By harnessing a worldwide network of data-driven, proactive, and operationally savvy experts, CTG is committed to elevating M&A value creation to new heights.

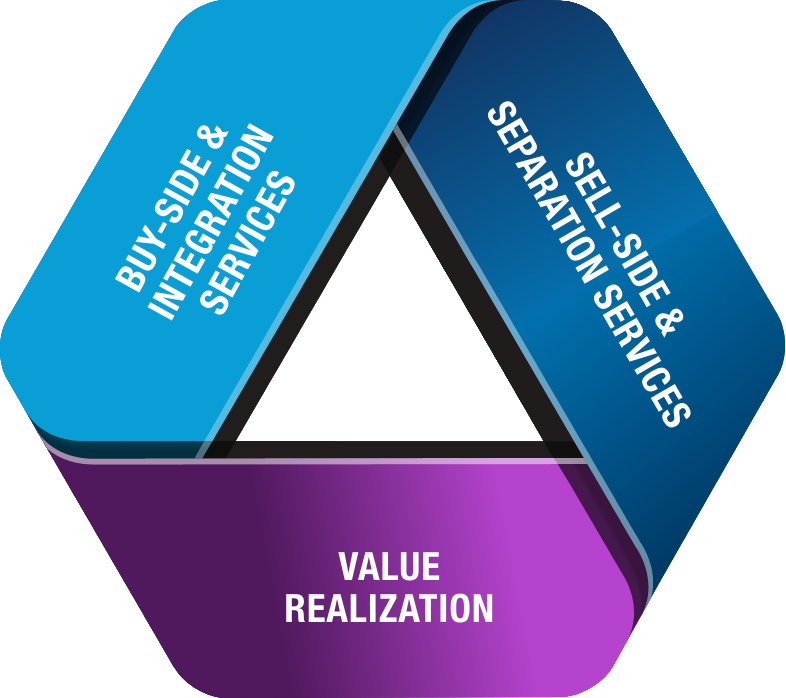

CTG delivers a full suite of M&A services including integrated due diligence and comprehensive integration and separation services to deliver value across the entire deal lifecycle. CTG is backed by the broader A&M organization that can uniquely offer interim management support and value realization post-close.

By harnessing a worldwide network of data-driven, proactive, and operationally savvy experts, we’re changing the M&A landscape with a track record of business transformations success and shareholder value creation.

Recognized by Vault as a top ranked consulting firm globally, we set the standard for helping clients tackle complex business issues, boost operating performance, and maximize stakeholder value.

Preston Parker Is A Managing Director And U.S. Practice Leader Of Alvarez And Marsal’s Corporate Transactions Group In Washington, D.C.

Mr. Parker Specializes In Advising Corporate Clients Through The Transaction Lifecycle, And Has Worked On Deals From $100 Million To $60 Billion In Size. His Primary Area Of Concentration Is Leading Complex Transactions And Transformations, Helping Clients Identify And Maximize Short- And Long-Term Value From Their Deals.

With More Than 25 Years Of Deal Advisory And Strategy Experience, Mr. Parker Brings Expertise In Integration, Buy- And Sell-Side Carve-Out Transactions, Tax-Free Spins, Bankruptcy, Gaap To Ifrs Transitions, Sarbanes-Oxley Act (Sox) Compliance, Shared Services Implementation And Enterprise Software Implementations. He Has Worked With Clients Across Various Industries, Including Financial Services, Consumer Products, Life Sciences And Healthcare, Hospitality, Gaming And Diversified Industrial Markets.

Prior To Joining A&M, Mr. Parker Spent 10 Years With Kpmg In Tysons Corner, Virginia, Where He Most Recently Served As Global Head Of The Deal Advisory And Strategy Integration & Separation Practice And Transactions To Transformations Leader In The U.S. During His Tenure, He Served Hundreds Of Clients Through Complex Transactions.

Notably, Mr. Parker Advised On The Global Separation Efforts Of A $16 Billion U.S. Multinational In The Divestiture Of Its Pharmaceutical Business Via A Tax-Free Spin; Led The Carve-Out Of A $5 Billion Multinational Manufacturing Business; Advised On The Acquisition Of A $4.5 Billion Utility; And Provided Transition Planning For A Buy-Side Carve-Out Of A $1 Billion Division Of A Large Healthcare Provider.

Mr. Parker Earned A Bachelor’s Degree In Management Science And Information Technology From Virginia Tech And An Mba From Georgetown University’s Mcdonough School Of Business. He Has Served On Numerous Academic And Philanthropic Boards, Including Georgetown University Mcdonough School Of Business Advisory Board, Virginia Tech’s Pamplin College Of Business Finance Board And Wolf Trap Foundation’s Club 66 Board. He Is Also A Regular Speaker At Industry And M&A Forum Events.