The trends of the M&A market at a glance! On this page we present the current developments of the transaction market in Germany – starting with a deep dive of the private equity market. What is the number and value of deals with published takeover values? COVID-19 has not stopped the private equity market and there is a catch-up effect with many well-known targets that have been on our radar since last year.

Pursue your own timeline!

- Pace is still on a very high level – the more work that is done ahead of the official start, the higher the chances are of winning.

- Deal activity also remains high, especially in the small/midcap segment as there is a lot of activity going on.

- Even corporates sometimes only win the silver medal – speed and occasionally price are the key issues.

- One of the largest transaction in June was the acquisition of Caseking by HAL Investments with a rumored EV of €820m followed by a fund raise of €650m for wefox – implying an EV of around €3bn … TMT is still the sector with sky rocketing valuations!

- Significant deal volume and activity is in and around Healthcare and TMT – Orgentec, Real Eyes, Xantaroa and thinkcell to highlight a few deals that happened in June.

- There has been an increase in “silent” processes – assets that have been on the deal list since COVID-19 started and now are sold in 1-to-1 or small auctions below the overall radar.

- Overall, valuations and multiples still remain very high but we are experiencing a higher fluctuation for doing deals – either deals are done very fast or are taking much longer.

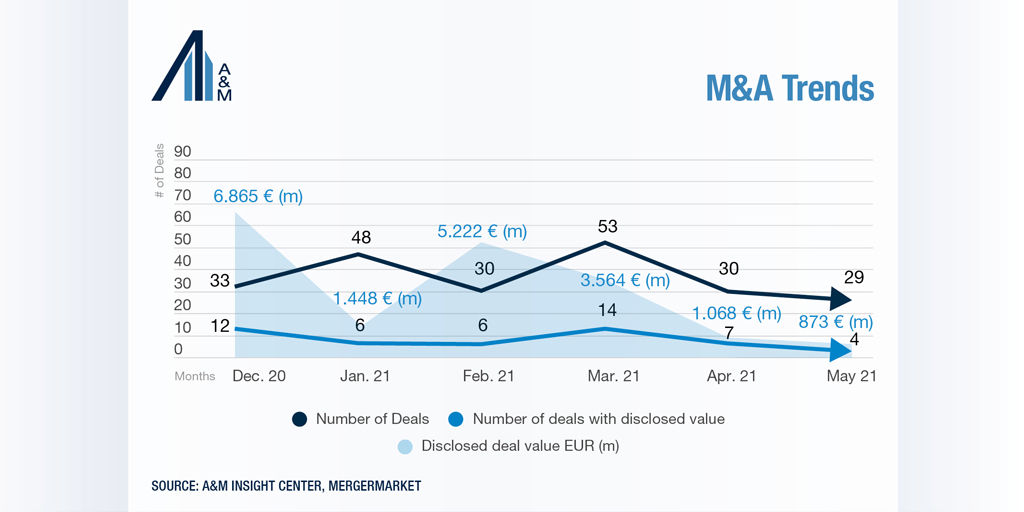

May 2021

Speed is KEY!

- As said in our April edition, speed is even more key to win a transaction. A process letter seems dated right after it is issued.

- Deal activity is on an ongoing extremely high level. The main driver continues to be the high Private Equity activity on both buy and sell- side.

- Corporates are also realizing opportunities and are strengthening their own business and expanding market share by ongoing high levels of acquisitions.

- Largest public acquisitions relate to the startup Trade Republic Bank successfully closing a financing round of €900m with two new investors TCV and Thrive Capital. Clear sign that FinTec is a very hot topic!

- German brand names are also changing ownership more and more– Birkenstock footwear was finally acquired by L Catterton; Nanogate was acquired by Technoplas, a U.S.based corporate.

- Health care sector also showing very high deal activity and attracting lots of interest – recently FairDoctors was acquired by Ergon Capital.

- Valuations still on the high to very high end – the most important question is will those ever come down to typical “normal” levels or do we see today’s levels as the “new normal” of valuation multiples?

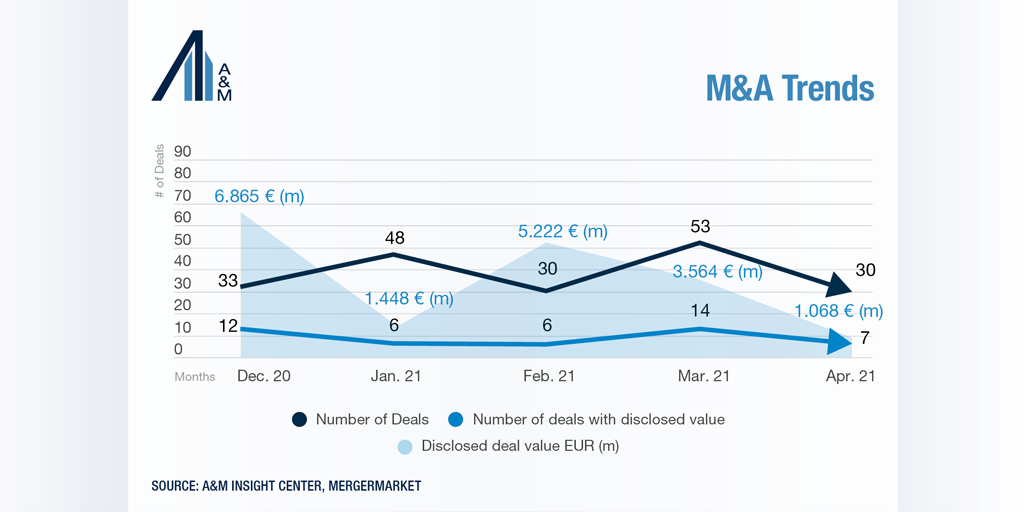

April 2021

Key trends of the private equity market:

- By the end of April 2021, the number of private equity deals more than doubled compared to the previous year’s close. A lot of transactions started end of the last year and successfully signed in the first four months.

- Speed is still a key success factor – the deadlines communicated in typical process letters are often overtaken by funds wishing to pre-empt. And in the end those funds are successful. Two recent examples are the sale of Schock Group as well as the sale of Engelmann Sensor. The largest transaction with an announced deal value took place right at the beginning of the year: The Canadian Pension Fund CDPQ and Bombardier selling to Alstom at around 71 billion euros.

- The signed deal activity was low in February, however many deals were in the middle of the sales process.

- Valuations are still at the high end of the historical spectrum, double-digit multiples are the norm, ignoring industry trends. We also observed more transactions with typical EBITDA multiples close exceeding 15 times. It’s still to be determined whether this trend manifests itself into the “new normal”.

Jürgen Zapf is a Managing Director with Alvarez and Marsal GmbH Wirtschaftsprüfungsgesellschaft. He is co-leading the German A&M practice and heads the firm’s German Transaction Advisory Group. Mr. Zapf specializes in providing financial and related due diligence advisory services to private equity houses, debt providers and large corporates, advising throughout the whole transaction lifecycle.