Publish Date

Dec 21, 2023

Region: North America

Recent investments by EQT, I Squared, 3i, BlackRock, and Macquarie Asset Management typify the heightened interest and flight to integrated waste assets. Financial investors are drawn to the waste and recycling space to further diversify infrastructure investment portfolios and better hedge against future disruptors. Sector attributes attracting financial investors include:

Often the core strategy for a waste business is to be vertically integrated, which starts with disposal and processing facilities. These assets often provide strong barriers to entry given the permits required and capital to buy/construct. New market entrants require technical expertise, patience, and deep pockets. Asset scarcity, particularly those in close proximity to waste generation hubs, provides tremendous leverage to build strong collection operations and execute sales-focused strategies. In some segments of the sector, large collection operations provide a similar moat, given the density gained from highly contracted revenues.

Traditional infrastructure investments are often characterized by average growth and predictable long-term cash flows. Waste management companies often secure intermediate to long-term contracts with municipalities, commercial entities, or waste management authorities. Enforced contracts provide stable and predictable revenue sources, lowering overall investment risk and creating stickiness with the customer. Furthermore, waste management, including collection, processing, and disposal, is essential in maintaining public and environmental safety. The critical nature of the service creates inelastic demand that further insulates the investment and makes it attractive to financial buyers. Also, the sector is extremely disciplined in pricing which results in an efficient market fully capable of recalibrating itself quickly as market dynamics change. The participants fully well understand the nuances around the pass-through nature of labor and fuel costs in the sector.

The waste sector uniquely offers recurring revenue streams that are resistant to fluctuations in the economy. Municipal Solid Waste (MSW) forms the bulk of all waste generated in the market and its volume is rarely affected by economic downturns or other major events such as a natural calamity or an epidemic. Such waste keeps getting generated and requires uninterrupted collection and management. Low sensitivity to swings is an important characteristic of the waste sector that is critical to infrastructure investors not only because it is lower risk but also because it smoothens overall portfolio performance when funds are allocated to higher volatility industries. Diversification also exists within the waste sector itself, with different end markets served, services provided, geographies, and contractual agreements, the sector provides flexibility in varying market conditions.

Most infrastructure assets sustain long-term operations with minimal ongoing capex relative to the initial development cost. This makes an infrastructure investment attractive since extensive capital allocation is not required over the asset’s lifetime. In recent times there have been opportunities for modernization such as upgrading a fleet to fuel-efficient vehicles and while these advancements require capital investment in the near term, lower future capital expenditures are expected; this translates to one of many value-creation opportunities that could attract investors and PE firms.

Increased individual awareness and looming stricter regulations imposed by government agencies worldwide are aimed at reducing waste and promoting sustainability. Governments and regulators have enforced compliance monitoring in accordance with environmental safeguarding targets. Tighter environmental regulations such as landfill avoidance rules and ESG regulations are leading to increased M&A activity as operators scale up to mitigate supply chain challenges in the wake of tighter policies. Consolidations and vertical integration provide end-to-end control of the waste value chain enabling economies of scale aimed at reducing costs and carbon footprints.

Private equity and infrastructure focused investors look for unsaturated markets whereby market share and profitability can be protected from downturns. The waste sector is characterized by stable, predictable cash flows secured by high barriers to entry, inelastic demand, and opportunities to leverage economies of scale across varying markets. In addition, waste infrastructure is considered a defensive investment since it experiences low volatility and supports investor portfolio diversification to further mitigate investment risks. Like all sectors, there are challenges that investors should be aware of such as evolving regulatory regimes, emerging technologies, and political instability. However, we can continue to expect infrastructure investment activity, particularly in the waste management sector, due to favorable investment characteristics and a growing focus on global sustainability.

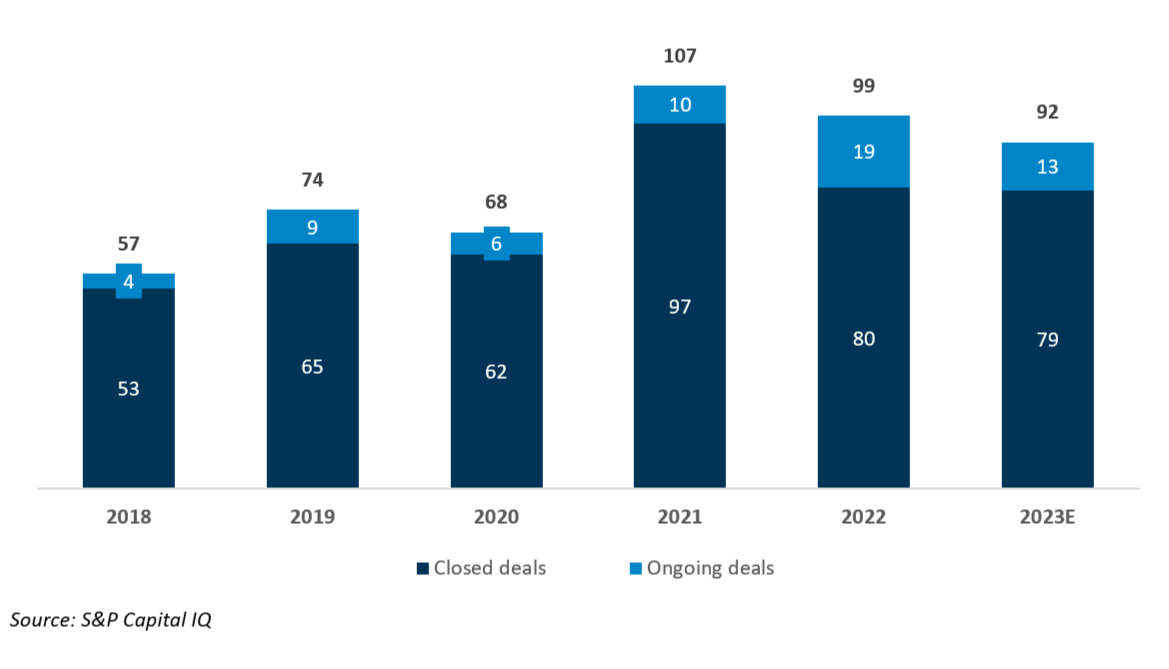

Chart 1.1 In recent years (2021 – 2023E), there has been a surge in transactions in US and Canada indicating a strong appetite for investment in waste and recycling infrastructure.

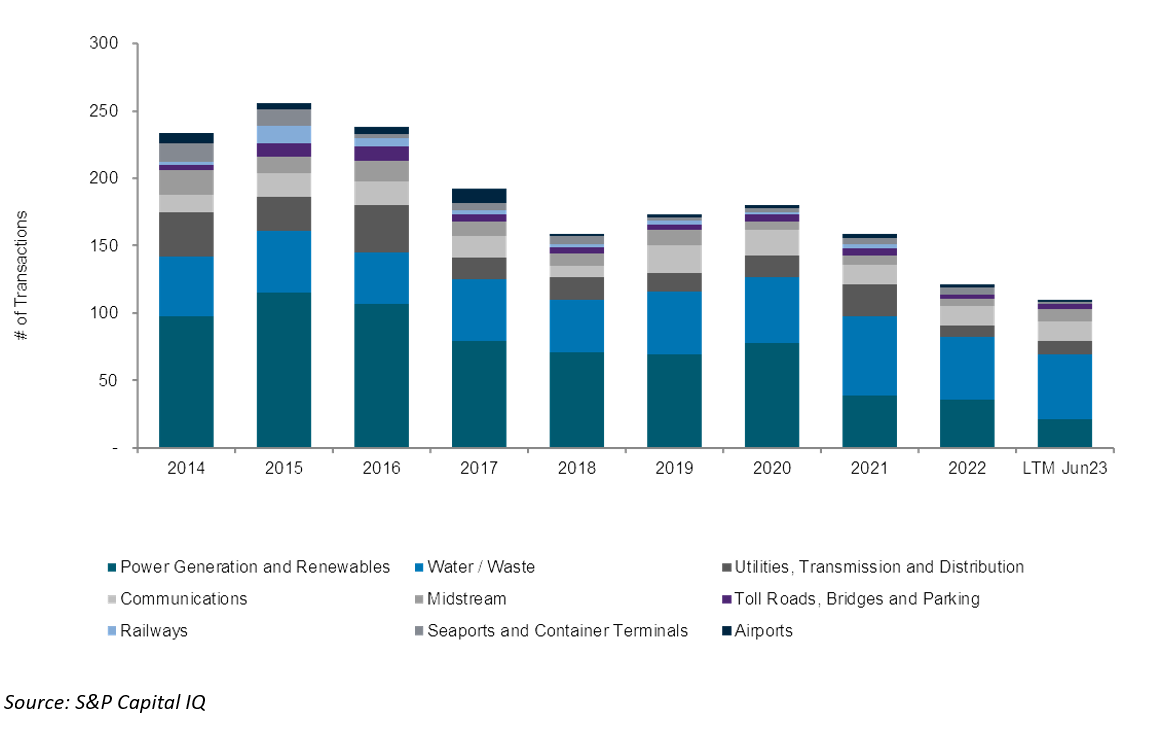

Chart 1.2 In recent years (2021–LTM Jun23), around 40% of all infrastructure transactions globally have been in the Water and Waste space, up from around 25% in the 2017-2020 period.